A comparative market analysis (CMA) is a study that estimates the suitable selling price for a property based on the prices of recently sold properties in the same area, AKA comps. CMA reports are usually created by real estate agents or brokers to let sellers come up with the right pricing for their property.

Buyers get similar insights from such reports by comparing the property they are buying with recently sold homes in areas that share similar features.

So, a thorough CMA real estate report is essential for both buyers and sellers to make informed decisions. One might say a CMA is more or less like a scale that weighs all factors to strike a balance and give a fair estimation of the property’s worth.

What is CMA in Real Estate?

The sole purpose of a CMA real estate report is to make sure that a property is priced accurately. Back in the day, you might have done this less technically. Perhaps you were at a weekend barbecue, flipping burgers with your neighbor, and you casually asked, “Hey, didn’t you sell your house last month? What did it go for?” Then, as you nibbled on some chips, you followed up with, “Do you know what the Johnsons down the street got for theirs?”

Equipped with that info, you’d then mentally calculate, “Well, if their place sold for $200,000 and ours has a bigger backyard, we could probably aim for $220,000.” Just like that, without spreadsheets or fancy tools, you’d do your very own CMA. The only thing that has changed today is the way we do this comparison, solely to make sure that our estimation is more accurate.

The Steps of a Comparative Market Analysis

As a real estate agent or broker, you might want to learn how to come up with a CMA real estate report to provide better services to your clients. To do so, you should first take note of all features of the subject property and then, look for similar properties that have recently been sold.

First, let’s see what those features are.

The neighborhood

One of the key factors in determining the value of a property is the location:

- In which area/district is the property located?

- What amenities are in its vicinity?

- How crowded is the neighborhood?

- How safe is the neighborhood?

- What the local schools are like? and,

- How accessible is public transportation?

After assessing these location-based features, you can look for nearby neighborhoods with similar features.

However, this is only half the picture. For the other half, you need to evaluate the property itself, and that entails the following features:

Square footage

Other factors aside, the bigger the property, the higher its price. And apart from the size, you should consider the number of rooms. The more spaces (bedrooms, bathrooms, etc.) a property has–provided that they have a notable size for their purpose–the higher its value.

The property condition

The age of the property and whether it’s been recently renovated should factor into your final evaluation. Generally, properties with fewer maintenance issues are valued higher as they present less hassle for potential buyers. The exception is properties with unique historical or architectural significance, whose value may increase despite potential maintenance needs.

Property taxes

A property’s annual tax bill is another key factor that can impact its value. Buyers often consider the tax burden when evaluating the overall cost of owning a property. In some cases, higher taxes deter potential buyers, while lower taxes make a property more appealing.

Special property features

Some properties have special features like outdoor pools, patios, fenced yards, high ceilings, open floor plans, and so on. Each of these features adds something to the overall value of the place, and you should consider them when making your final comparison.

Utility infrastructure

Another important factor is the quality of essential services like water, electricity, sewage, gas systems, etc. Properties with reliable and modern utility connections are often more appealing to buyers. Poor or outdated utilities can reduce a property’s desirability and affect its overall value.

Legal considerations

Legal considerations include factors such as zoning rules, land use regulations, and any disputes tied to the property. Buyers are often attracted to properties with no existing liens or unresolved legal issues, as these ensure a smoother transaction. Complications like boundary encroachments or restrictive easements can deter buyers and affect a property’s worth.

Select the Comps

After carefully evaluating the subject property, you should find at least three comparable properties, or comps, to estimate the right price for the property in question. Keep in mind that the properties you choose as comps must:

- Have been sold recently (that is, in the last 3-6 months);

- Be located in the vicinity of the subject property;

- Be located in a similar neighborhood;

- Be as similar to the subject property as possible in terms of size, age, accessibility, number of rooms, etc.;

- Be in a similar condition regarding general upkeep, renovations, upgrades, etc.; and,

- Have almost the same quality for both exteriors and interiors.

Also, be careful about basing your judgment on online listings where property descriptions might not be as detailed as they should and the attached photos/videos might have been edited.

Though the comps are ‘not expected to be exactly the same as the subject property,’ finding valid comps is easier said than done, as properties often differ in at least a few key factors. After making sure that the properties you’ve selected are the most similar ones to the subject property, you can make the comparison.

How to Calculate a CMA Real Estate?

To make a healthy comparison, start by adjusting the sales prices of comps to make them more similar to your property. If a comp is missing something your property has, like a bigger yard, lower its price to reflect that. Similarly, if it has something better, like a renovated bathroom, raise its price accordingly. This helps you figure out what the comp(s) would sell for if they were more like your property.

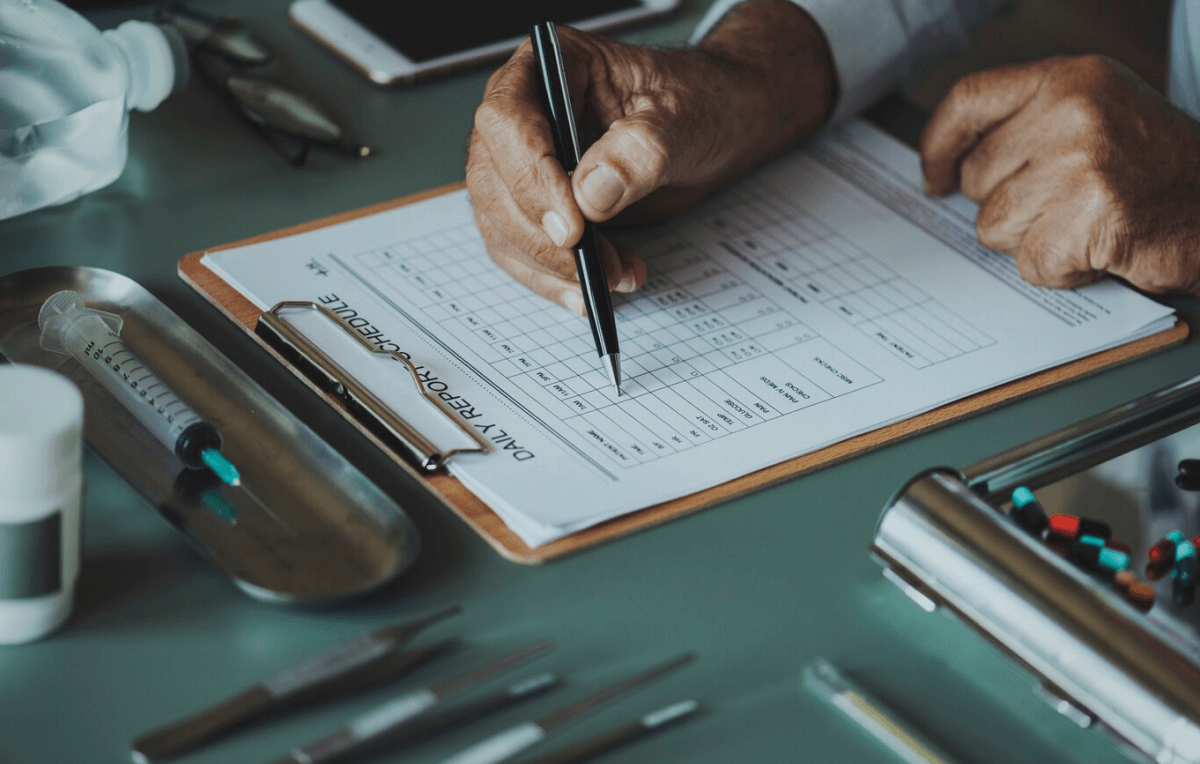

Next, find out the price per square foot for each comp by dividing its adjusted price by its size. Then, to estimate your property’s value, multiply the lowest price per square foot by your home’s size to get the lower value range. Do the same with the highest price per square foot for the higher range.

Finally, calculate the average price per square foot for all comps, and multiply it by your property’s size to get the best estimate of its value. So, to wrap up, this is a CMA real estate formula:

Another option you have is to use a CMA real estate calculator that considers the above-listed features and makes the comparisons. If you prefer this option, you’d better avoid free CMA real estate ads and use a trusted tool that provides verified data and in-depth analysis. Now that you’ve calculated the value of the property, it’s time for the report.

Preparing a CMA Report

A lot of details can and should go into a CMA report, and it’s important to present those details in a neat and orderly manner. To learn how to prepare your report and present the information, you can search the web and find CMA examples.

In doing so, you’ll come across lots of free CMA templates that provide a clear structure for organizing property data, adjustments, and comparisons in a professional format. Choose one of those templates and customize it to fit your specific property and market data.

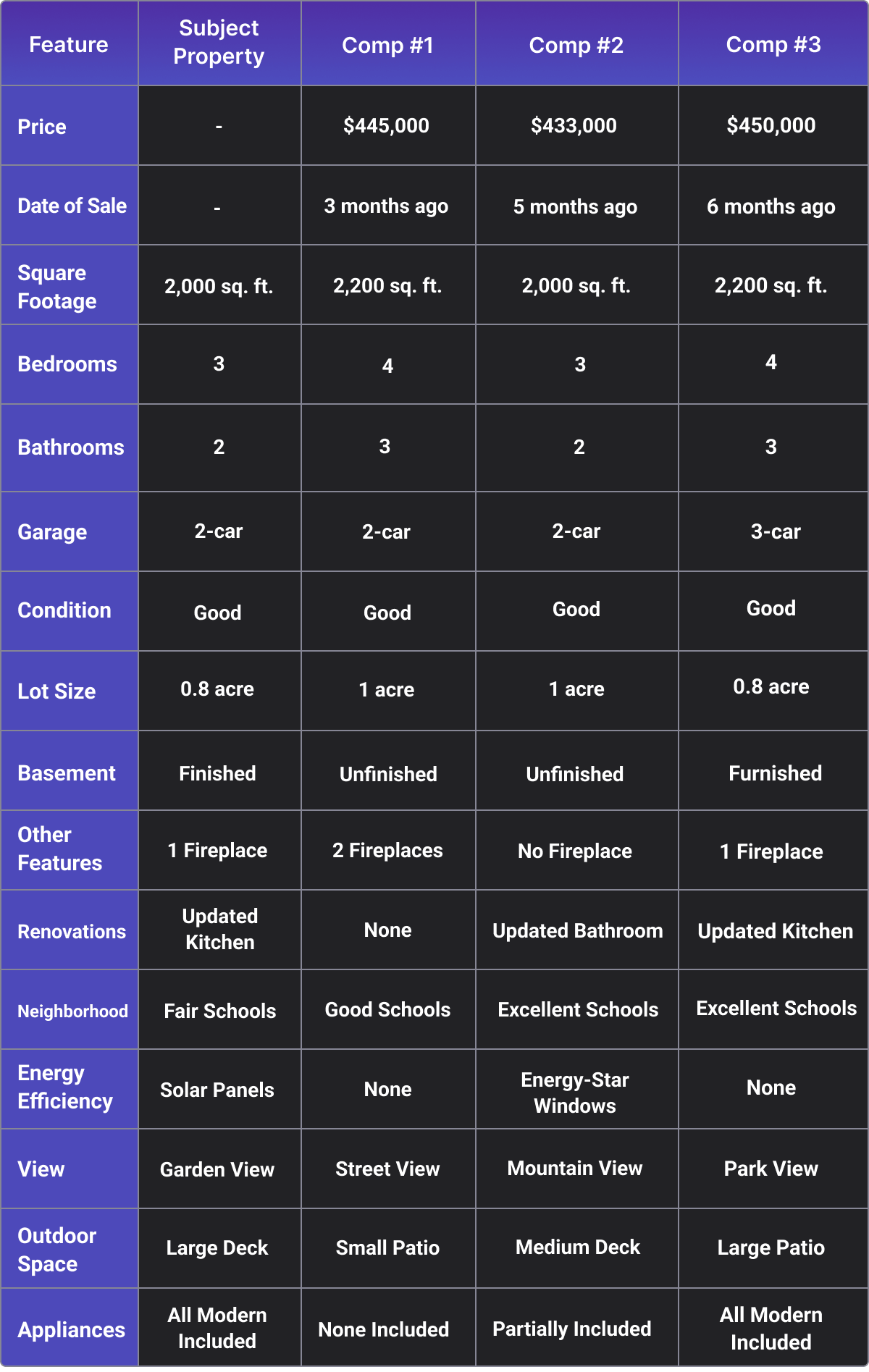

Here’s a simple example that details all features of the comps and the subject property.

Based on the information presented, we can conclude that the subject property is worth something around $440,000. It’s similar in size to Comp #2, which sold for $433,000, but it has a few perks that bump up the value, like a finished basement and solar panels. The other two comps sold for slightly higher prices due to advantages such as larger size, a better location, a bigger garage, or an additional bathroom.

How Does a CMA Differ from Home Appraisal?

Both practices are related to real estate comparative market analysis, but they are done by different individuals and serve different purposes.

A CMA is done by a real estate agent or a broker to estimate the right price for a to-be-sold property. An appraisal, on the other hand, is done by a licensed home appraiser for financing purposes like when the owner wants to get a mortgage.

So, a CMA benefits the seller while an appraisal benefits the owner who intends to keep the property. Also, compared to a CMA, a home appraisal is more detailed and hence, more accurate.

How Much Does a CMA Cost?

Agents typically offer CMAs to help sellers determine a competitive listing price or to assist buyers in evaluating a property’s value. However, if you’re not working with an agent and want a CMA from an agent, you might have to pay $100 to $500, depending on the complexity and detail of the report.

In Closing

There are two important points to keep in mind when preparing a CMA report: Firstly, if you can’t find enough recently sold properties that are similar, you can use currently listed properties as comps. Secondly, always factor in current market conditions when setting the price.

For instance, if the market is stronger at the time of listing, you might aim for a higher price than what your comparison suggests. Similarly, if the market is weaker or in a recession, you may need to adjust the price downward.

FAQs

There are a couple of real estate CMA calculators that you can use for your project. So, do your research and check product review pages. Cloud CMA, Toolkit CMA, and iCMALive are some of the most popular ones.