Since 1981, the National Association of Realtors (NAR) has been publishing its Profile of Home Buyers and Sellers, an annual report on home buyers and sellers. Typically released every November, this report highlights information related to buyer demographics, home preferences, financing methods, search processes, seller experiences, pricing trends, and the role of real estate professionals.

Thanks to the rich and reliable data available in the NAR Profile of Home Buyers and Sellers, this information is obviously highly valued by real estate professionals, home buyers and sellers, policymakers, and financial institutions. NAR collects this data through online questionnaires, and national sampling, engaging 6,000 to 8,000 participants each year.

Each profile covers a wide range of topics including:

- Characteristics of home buyers/sellers;

- Characteristics of homes sold/purchased;

- The home search process;

- Home buying/selling and real estate professionals;

- Financing the home purchase;

- Challenges during the selling process;

- Market trends; and

- Use of technology

To offer a clear understanding of the U.S. real estate market and its various aspects, we have compiled the findings from the last five profiles (2020–2024). This consolidation provides valuable insights into long-term trends, shifts in buyer and seller behavior, and the evolving challenges within the real estate landscape.

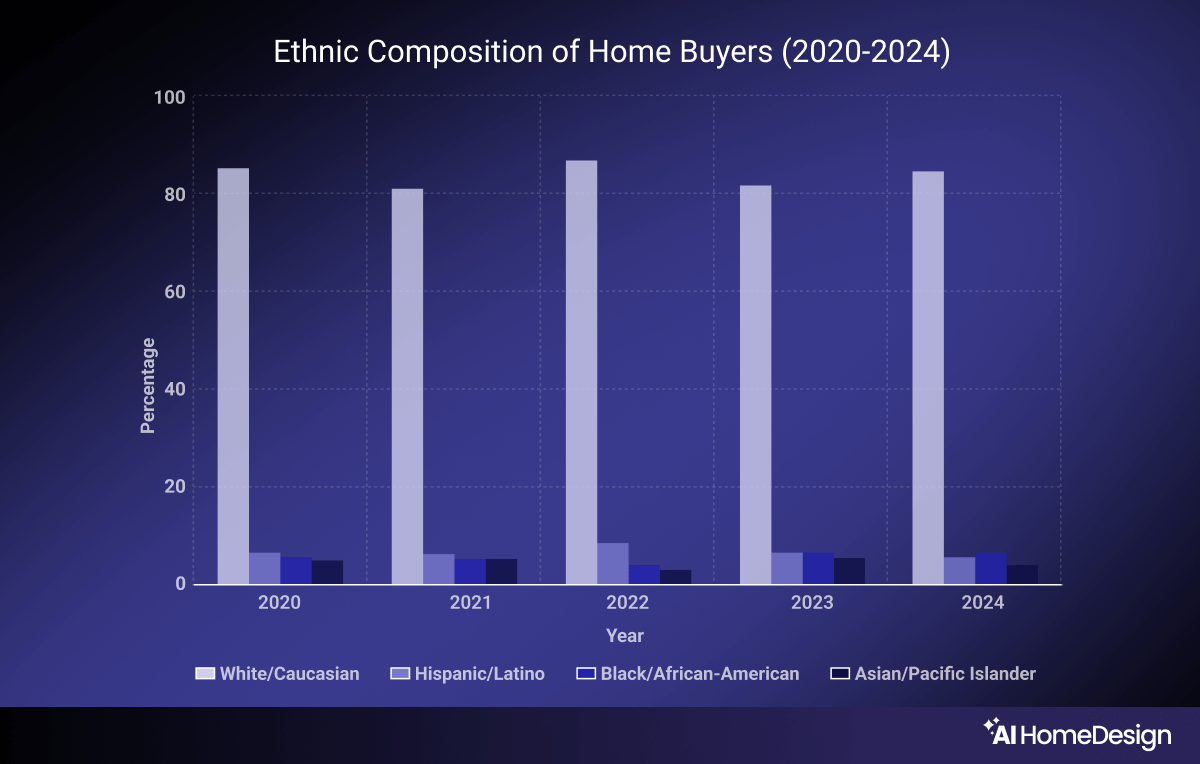

The table below gives you an overall look at the U.S. real estate market through these 5 years. However, if you’re into details, we recommend you keep reading as various useful insights are given for each section.

Characteristics of Home Buyers

Marital status

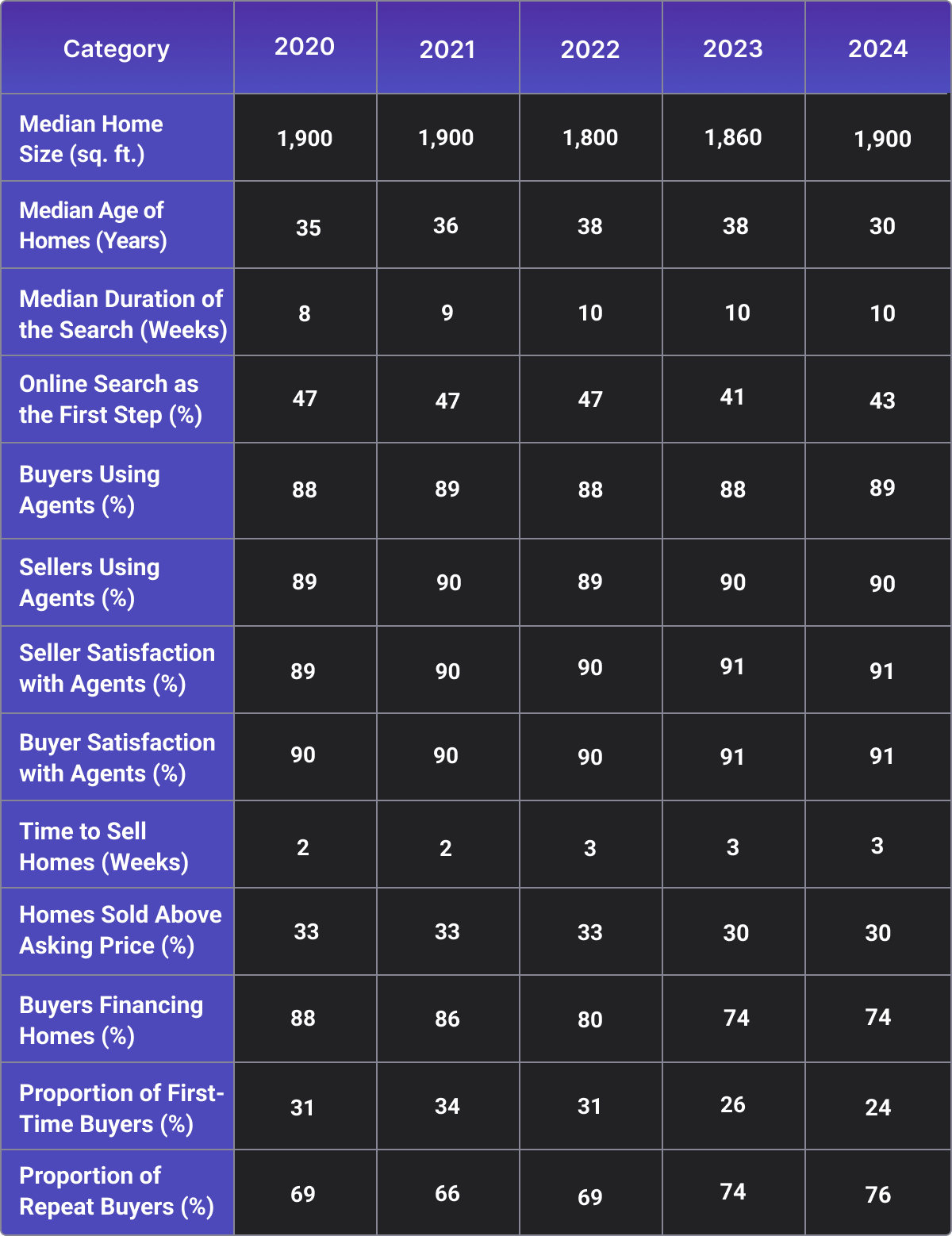

Between 2020 and 2024, married couples consistently represented the largest group of home buyers, accounting for 59%-62% of purchases in the U.S.

Single females made up 18-20% of buyers, doubling the share of single males at 9-10%. Meanwhile, unmarried couples contributed 6-8% to annual home purchases.

Ethnic composition

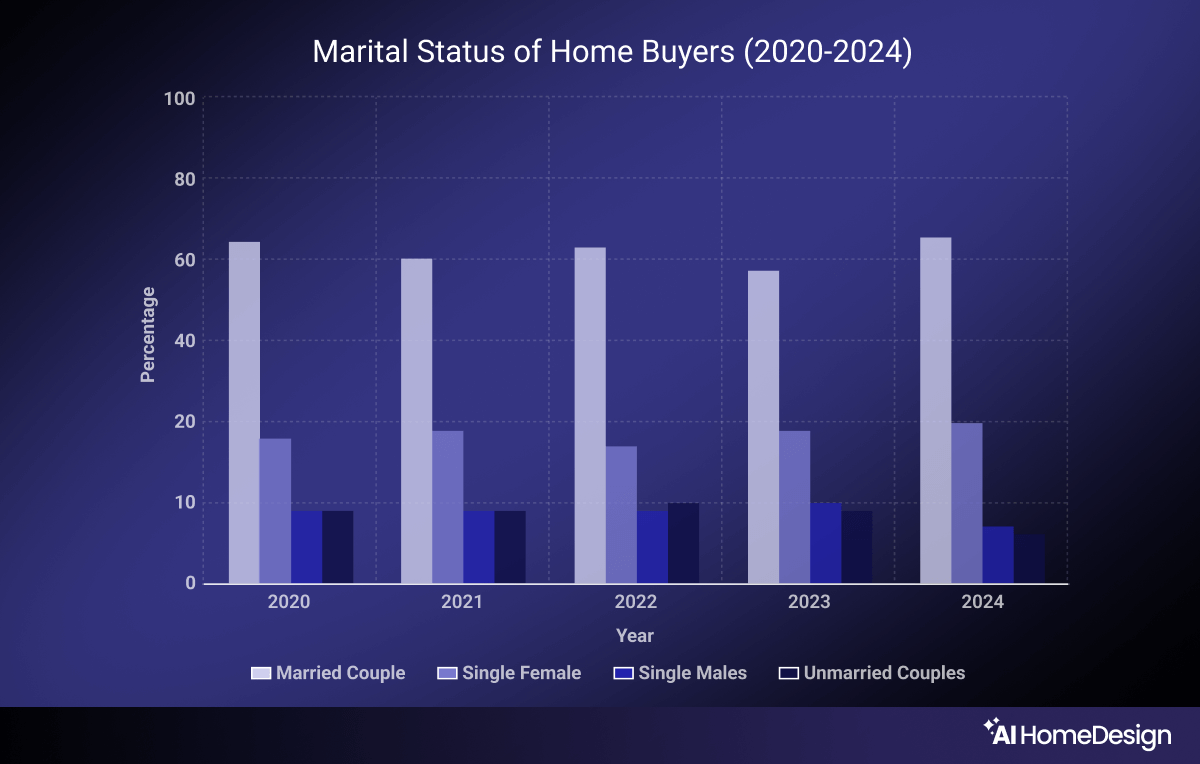

From 2020 to 2024, the majority of home buyers were White/Caucasian, comprising 81%-88% of the market. Hispanic/Latino buyers consistently represented 6%-8%, while Black/African-American buyers ranged from a low of 3% in 2022 to 7% in 2023 and 2024. Asian/Pacific Islander buyers accounted for a smaller segment, varying between 2%-6%.

First-time vs. repeat buyers

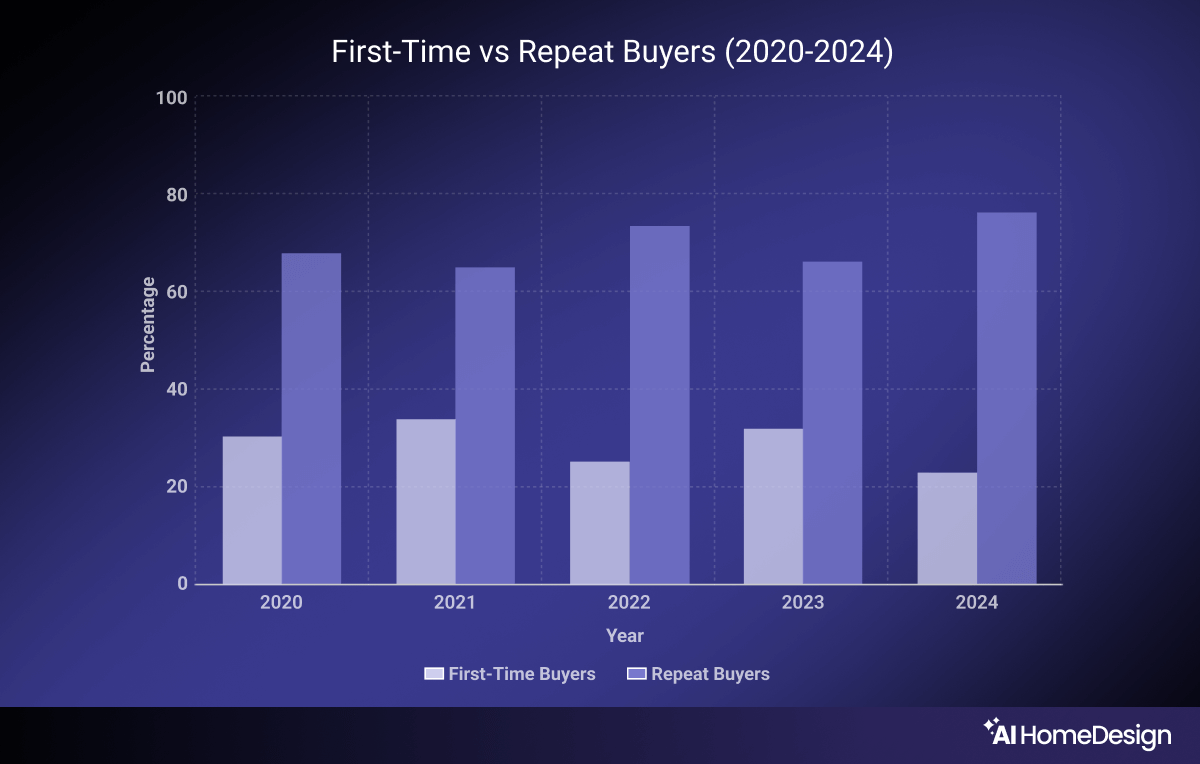

The proportion of first-time buyers varied over the years, reaching a high of 34% in 2021 but declining to a record low of 24% in 2024, underscoring the difficulties faced by new buyers in the housing market.

Meanwhile, repeat buyers–those buyers who’ve made their second purchase–gained a larger annual share, driven by an aging demographic with established equity. The median age of repeat buyers rose significantly, from 55 in 2020 to a historic 61 in 2024, highlighting the increasing presence of seasoned buyers in the market. This could also imply that repeat buyers have a higher chance than first-time buyers when multiple offers are made on the same property.

Motivation for purchasing a home

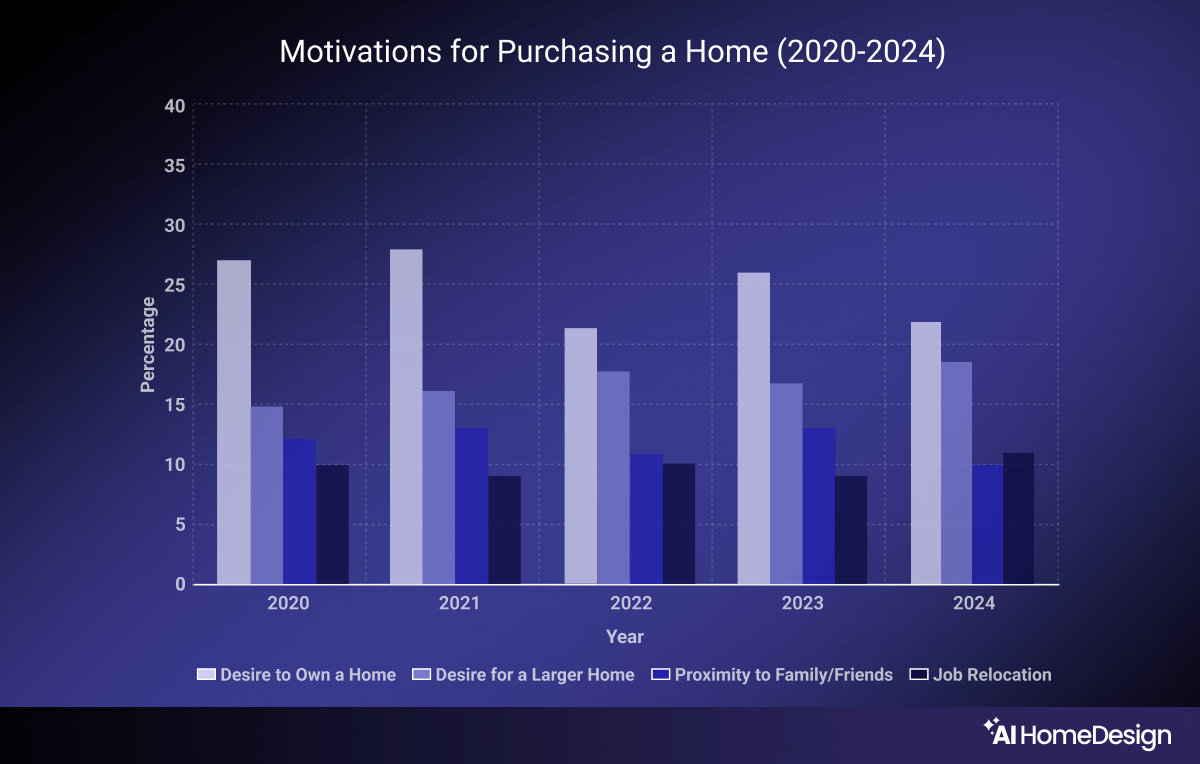

The primary motivation for purchasing a home, the “desire to own a home of their own,” remained the top reason across all years, peaking at 28% in 2021 before declining to 22% in 2022 and 2024. Among first-time buyers, this motivation was especially significant in 2024, with 64% citing this wish as their main reason.

Other notable motivations included the desire for a larger home, proximity to family and friends, job relocation, and changes in family situations, reflecting the diverse needs driving home purchases during this period.

Characteristics of Purchased Homes

Another key component of NAR’s annual report focuses on the Characteristics of Homes Purchased, providing a detailed look at the types of homes buyers choose, their features, and the factors influencing their decisions.

This information is invaluable to scores of stakeholders, including real estate professionals, investors, house flippers, developers, and policymakers, as it highlights emerging trends, buyer preferences, and demographic shifts. This information enables them to tailor their services, build relevant housing inventory, and plan for community development.

Types of homes purchased

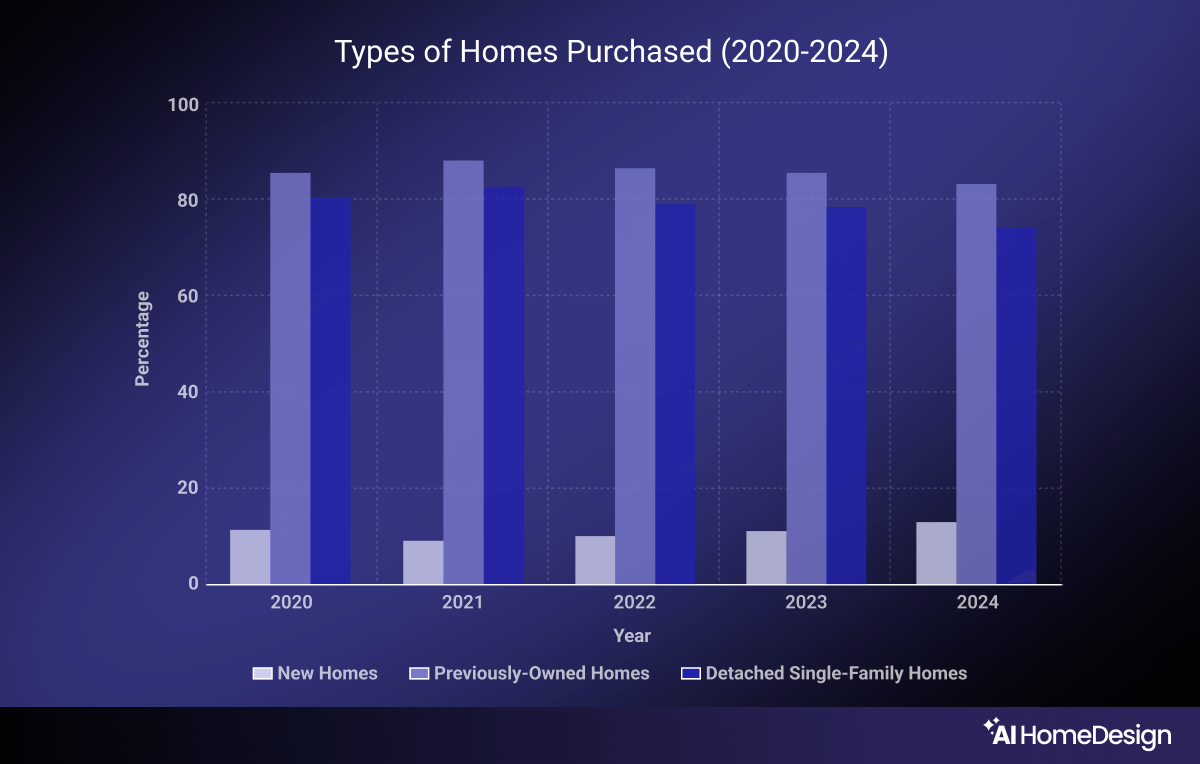

From 2020 to 2024, the majority of buyers consistently preferred previously owned homes, making up 85%–89% of purchases, though the share of new homes saw a slight increase, reaching 15% in 2024.

Detached, single-family homes remained the most popular choice, accounting for 75%–82% of purchases over the years, but their share declined slightly in favor of other housing types, such as townhouses and condos in 2024.

These trends reflect a steady demand for existing homes due to affordability and availability, alongside a gradual interest in alternative housing options. However, buying previously owned homes involves maintenance issues that buyers should look out for.

Home features

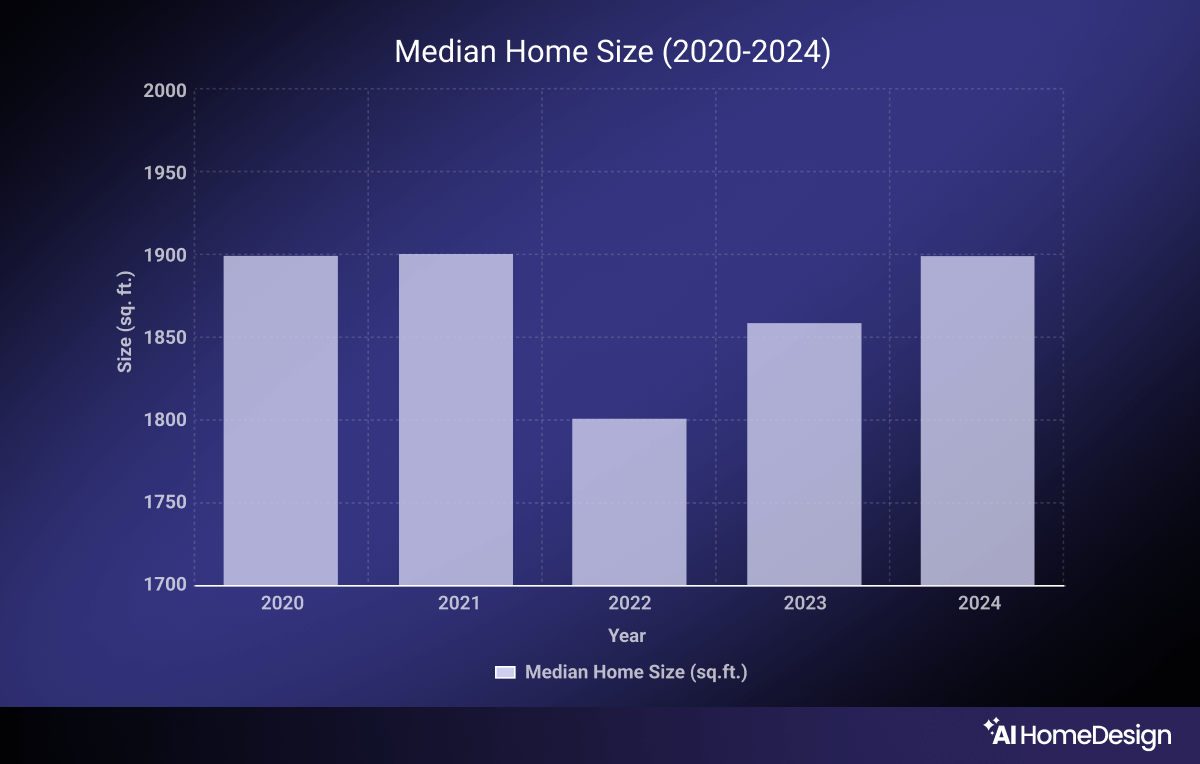

From 2020 to 2024, the median home size fluctuated modestly, starting at 1,900 square feet in 2020, dipping to 1,800 in 2022, and returning to 1,900 square feet in 2024. The typical space configuration remained consistent, with 3 bedrooms and 2 bathrooms being the norm across all years.

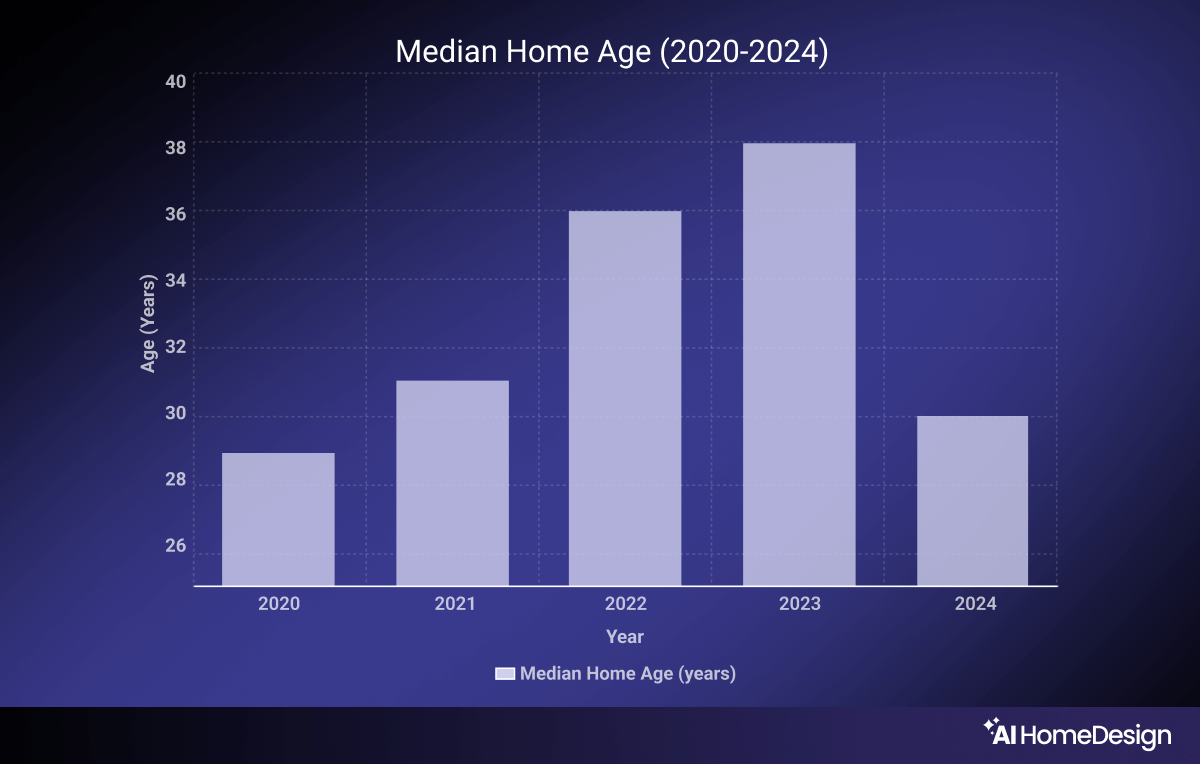

The age of homes showed a notable trend, with buyers favoring older homes between 2022 and 2023, as the median age reached 38 years in 2023. However, 2024 saw a shift back toward newer homes, with a median age of 30 years. These patterns reflect the balancing interplay between affordability, market inventory, and buyer preferences for space and functionality.

Environmental and neighborhood factors

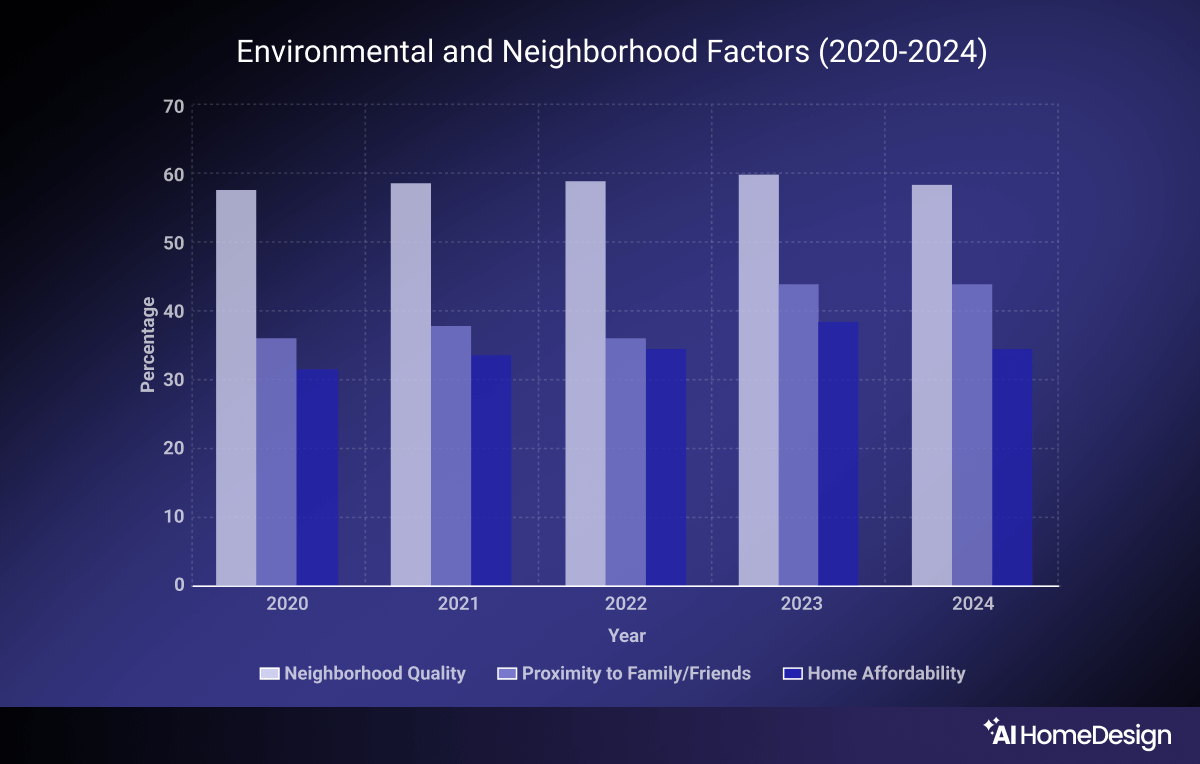

From 2020 to 2024, neighborhood quality consistently ranked as the top factor influencing home buyers’ location choices, with 58%–60% of buyers prioritizing it. The importance of proximity to friends and family grew significantly post-2022, stabilizing at 45% in 2023 and 2024, reflecting a shift toward social and familial considerations.

Home affordability also gained prominence, with 33% of buyers citing it as a key factor in 2020, rising to a peak of 39% in 2023 before settling at 36% in 2024. This highlights buyers’ increasing focus on community, affordability, and social connections when choosing where to live.

Distance moved (from previous home)

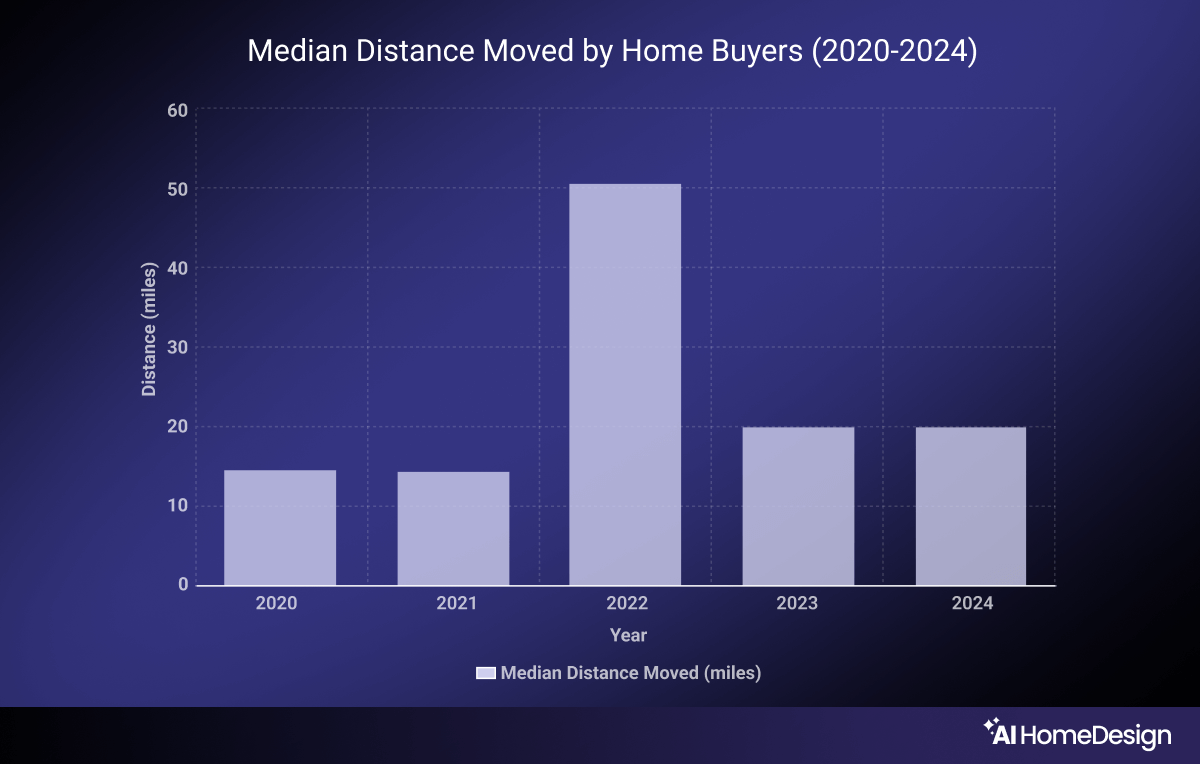

From 2020 to 2024, the median distance moved by home buyers fluctuated significantly, reflecting shifts in market conditions and buyer preferences. This factor remained steady at 15 miles in 2020 and 2021 but surged to 50 miles in 2022, as buyers sought homes farther from their previous locations. This could partially be due to remote work opportunities, and the aftermath of the COVID-19 pandemic. By 2023, the distance decreased to 20 miles and stabilized around that figure in 2024, marking a return to more typical moving patterns.

Takeaway: The bottom line for home buyers

So, to put all of the above in a digestible, metaphorical nutshell, the question is, “What does an average American have in mind when looking for a home?”

The typical American homebuyer looks for a single-family property with 1,900 square feet of space, a maximum property age of 30-38 years, a desirable neighborhood, and a location within 10-20 miles of where they currently live.

The Home Search Process

The Home Search Process is another critical component of NAR’s annual profile of home buyers and sellers, offering valuable insights into how buyers search for homes, the tools they use, and the challenges they face.

Real estate agents can use these insights to enhance their services, while technology providers can optimize tools like mobile apps and online search platforms. Together, this data helps stakeholders improve the overall house-hunting experience.

Initial steps in the home search

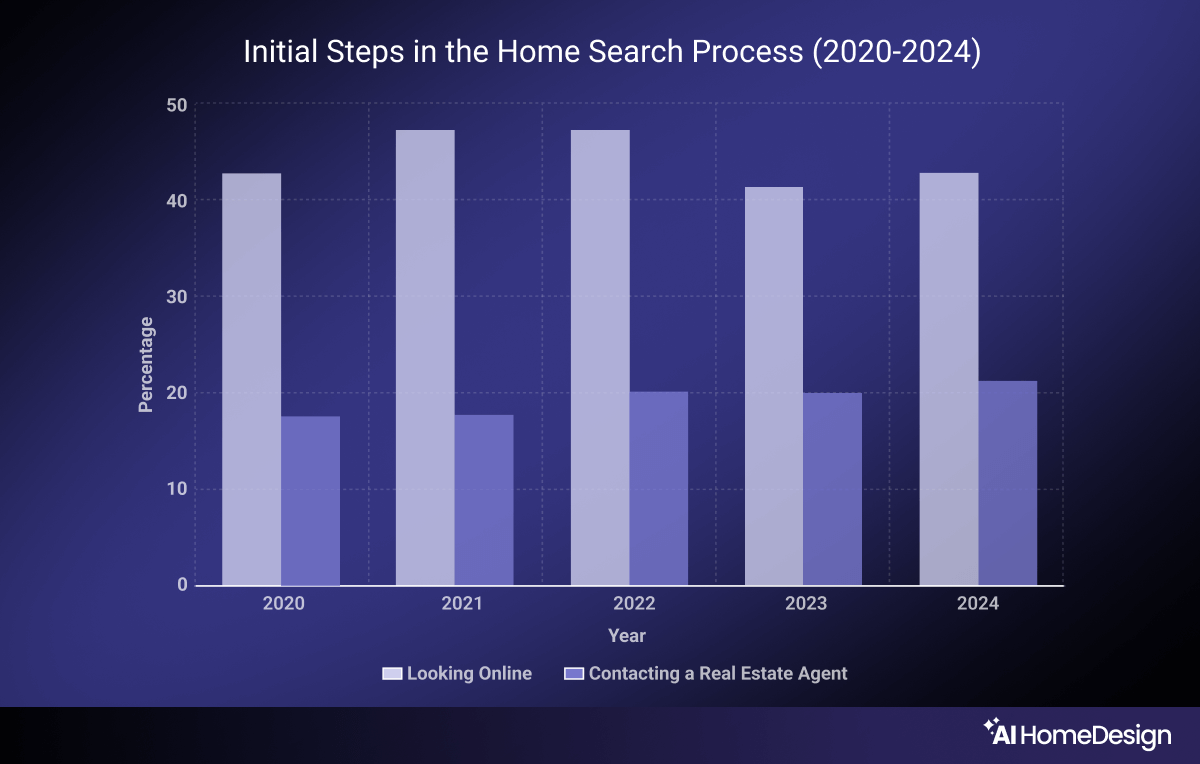

From 2020 to 2024, looking online consistently dominated the statistics as the most common first step in the home search process, with 43%–47% of buyers starting their hunt this way. While it peaked at 47% in 2021 and 2022, online searches saw a slight dip to 41% in 2023 before rebounding to 43% in 2024.

At the same time, 18%-20% of buyers choose to contact a real estate agent instead of looking online first. This highlights the importance of clients’ trust in agents and their ability to provide personalized guidance, expert advice, and access to exclusive listings that may not be available through online platforms.

Duration of the search

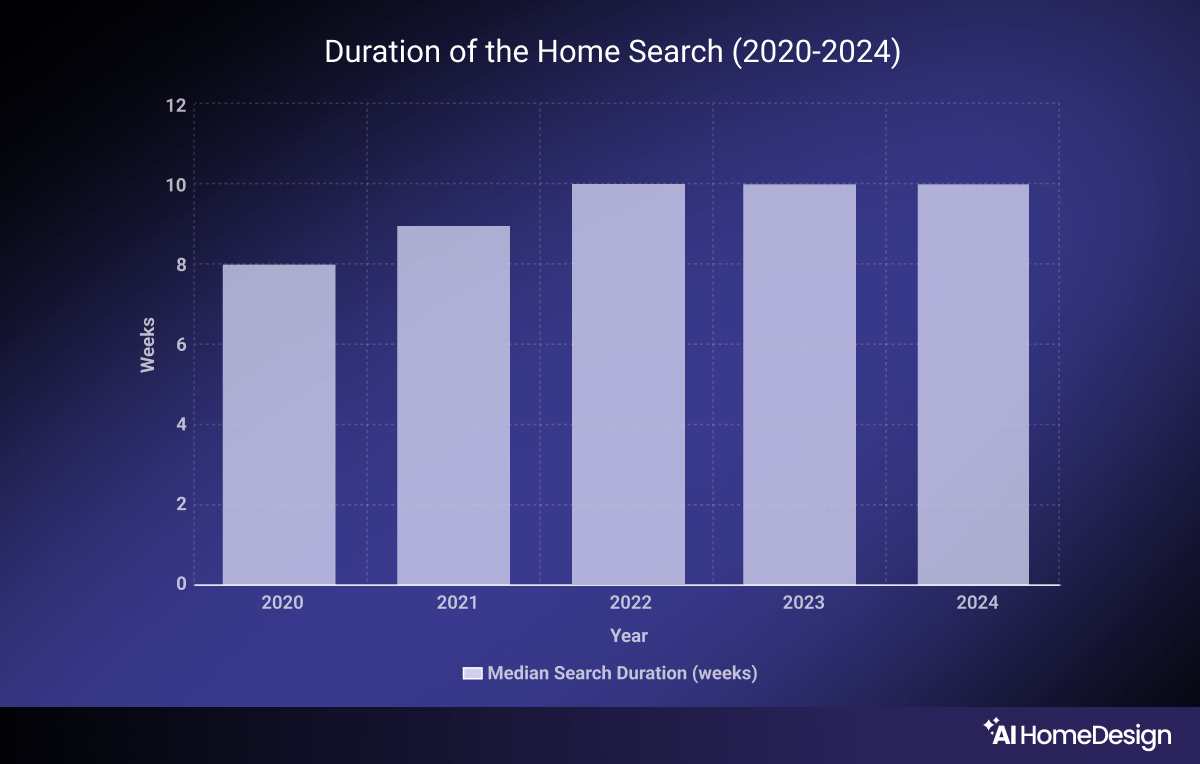

The duration of the home search gradually increased over the years, reflecting tighter inventory and higher competition among buyers. The median search time rose from 8 weeks in 2020 to 9 weeks in 2021, peaking at 10 weeks in 2022, where it stabilized through 2024.

This steady increase highlights the growing challenges buyers face in finding the right home, emphasizing the need for efficient tools, professional guidance, and strategies to navigate the competitive housing market more easily and swiftly.

Methods and tools used

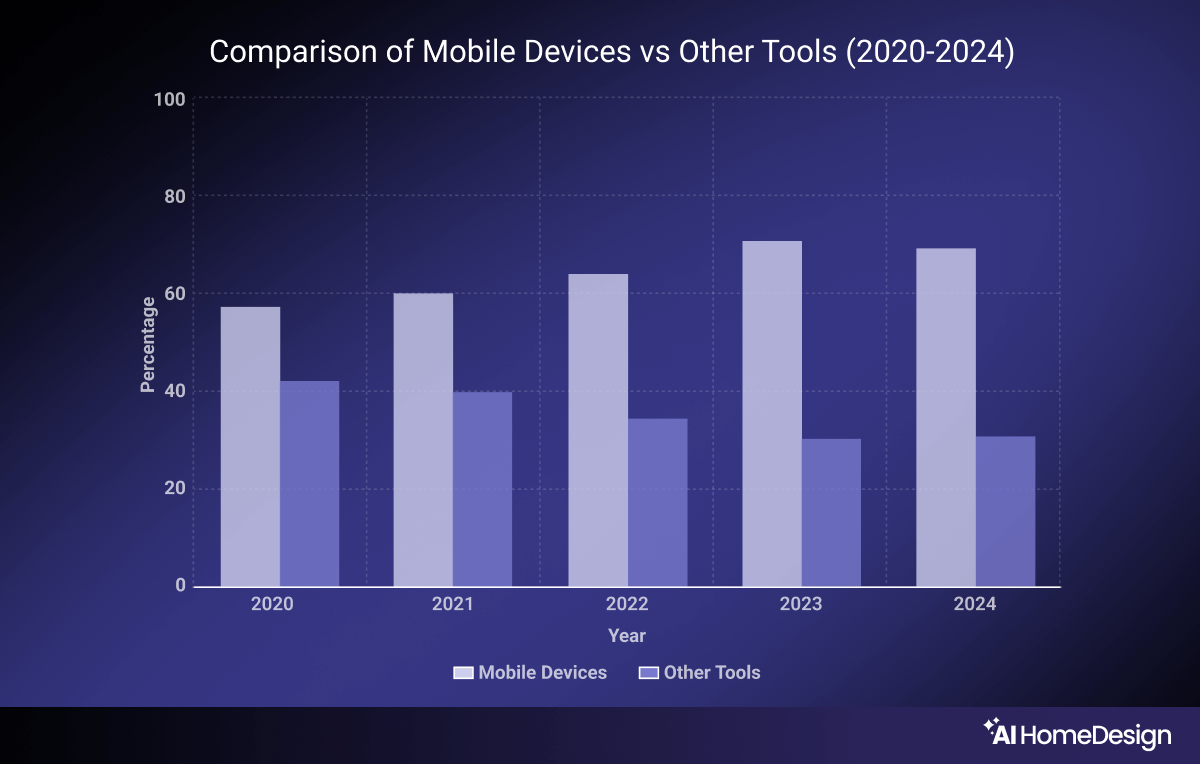

The Methods and Tools Used in the home search process evolved significantly from 2020 to 2024. In 2022, though much later than one would expect, the use of the Internet became nearly universal. 96% of buyers in 2022 relied on online resources, a trend that remained steady through 2024.

Similarly, the use of mobile devices for home searches saw continuous growth, increasing from 57% in 2020 to 69% in 2023 and 2024, reflecting the growing preference for convenience and accessibility.

These trends underscore the increasing reliance on technology to streamline the home-buying process and the importance of digital tools in shaping buyer experiences.

Potential challenges during the search

Buyers faced several challenges while searching for homes, with finding the right home consistently and quite naturally ranked as the most significant obstacle, cited by over 50% of buyers annually. Tight inventory, high demand, and affordability constraints contributed to this difficulty.

For first-time buyers, saving for a downpayment was another key hurdle, influenced by rising living costs, student loans, and credit card debt. Additionally, many first-time buyers struggled with understanding the home-buying process, highlighting the need for better education and support from agents and digital tools. These challenges underscore the complexity of navigating the housing market, particularly for more inexperienced buyers.

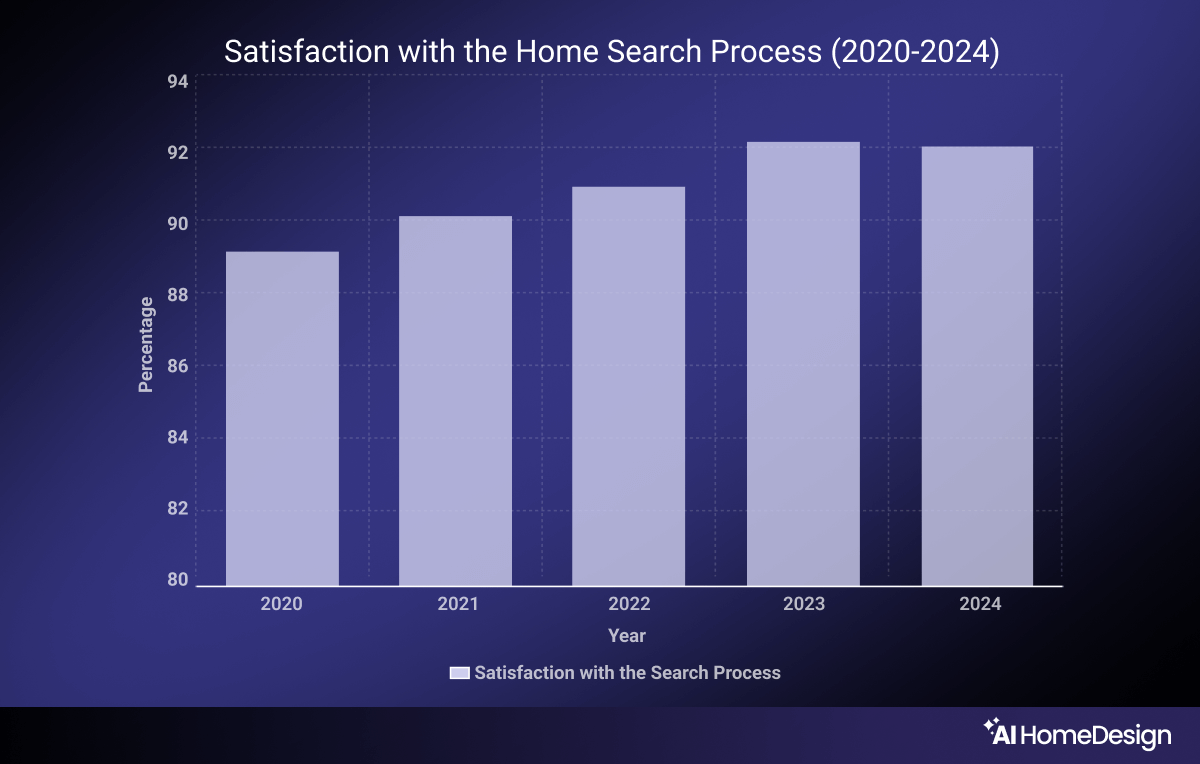

Satisfaction with the search process

Satisfaction with the search process improved from 89% in 2020 to 92% by 2023-2024, reflecting better tools and support for buyers. This growth in satisfaction can be attributed to better online tools, virtual tours, virtual staging, and enhanced real estate agent services, which together made the home-buying process more efficient and enjoyable.

Role of real estate agents

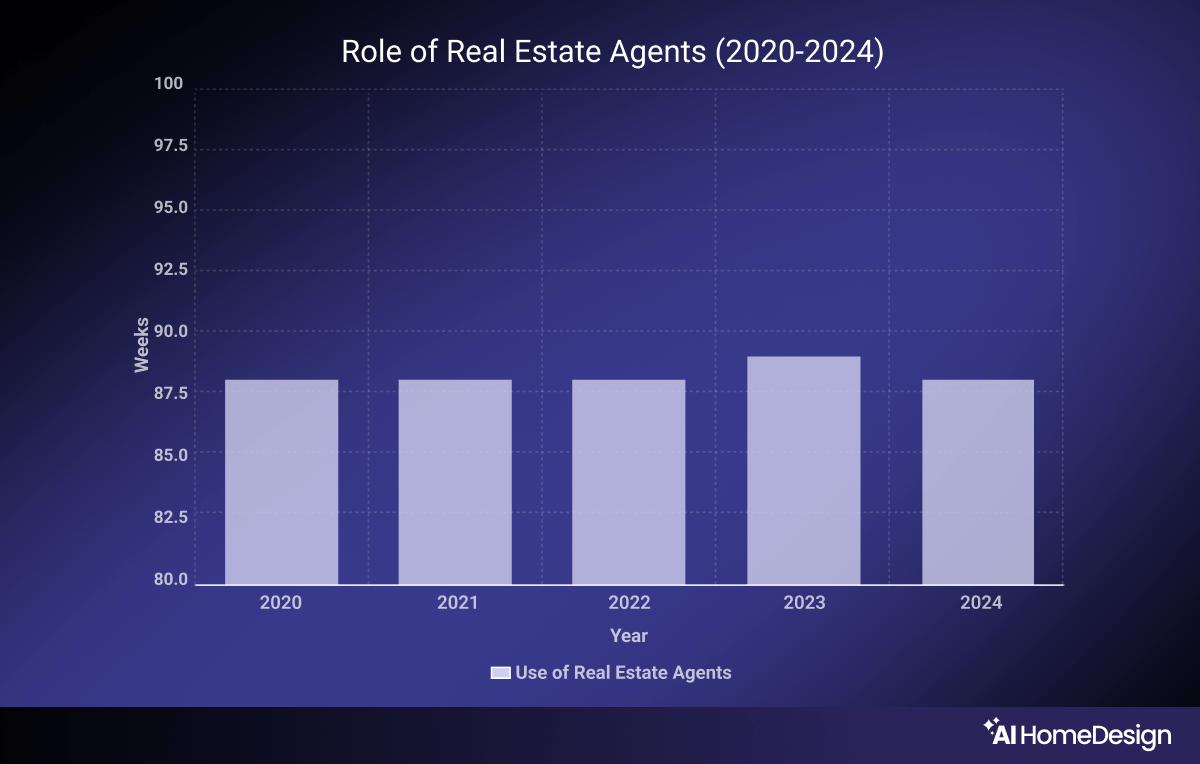

Real estate agents continued to play a vital role in the home-buying process from 2020 to 2024. The percentage of buyers hiring agents remained consistently high, starting at 88% in 2020 and remaining rather constant in subsequent years.

Buyers primarily sought agents for assistance in finding the right home, negotiating terms, and understanding the buying process. Interestingly, referrals from personal networks were the leading method of finding an agent, reflecting their reputation and trustworthiness.

Home Buying and Real Estate Professionals

The Home Buying and Real Estate Professionals section in NAR’s annual report provides critical insights into how buyers interact with real estate professionals during the home-buying process. This section of the data highlights trends in the use of agents, services provided, and the impact of professional guidance on buyer satisfaction.

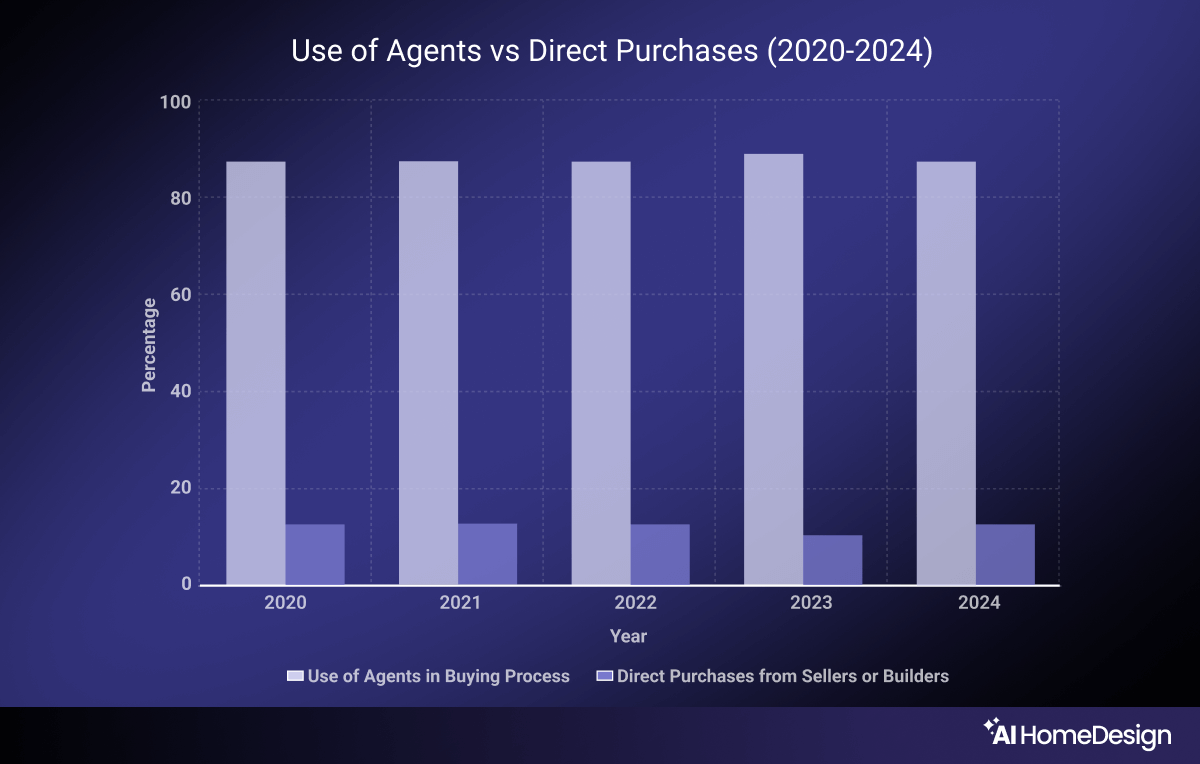

Use of agents in the buying process

The use of agents in the buying process has remained a dominant trend from 2020 to 2024, with nearly 90% of buyers relying on professional guidance during this period. Buyers primarily sought agents for assistance in finding the right property, negotiating terms, and managing complex transactions.

Meanwhile, direct purchases from sellers or builders accounted for a much smaller share, consistently hovering at just above 10% over the years.

This contrast underscores the enduring importance of real estate agents in simplifying the home-buying journey. Obviously, both buyers and sellers are putting their best trust in agents and, as these reports tell us, have returned the favor by making the buying//selling process as effortless as possible for buyers and sellers.

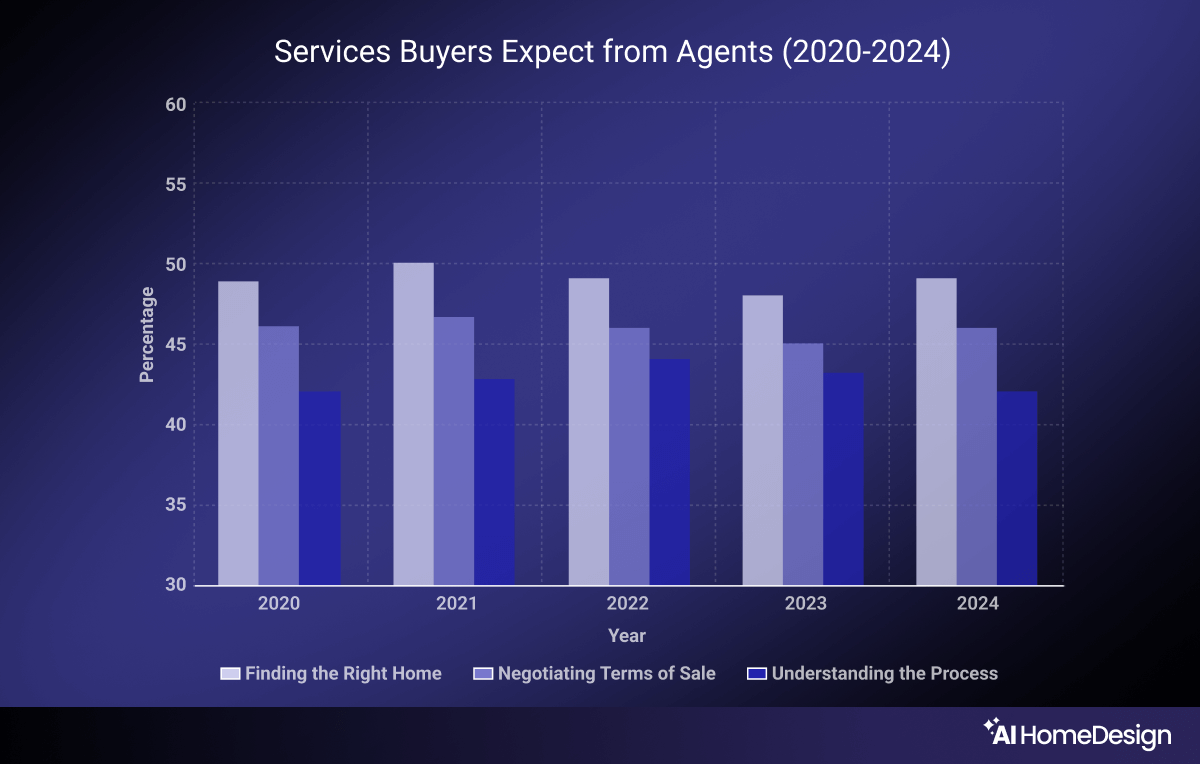

Services buyers expect from agents

Homebuyers rely on real estate agents for a variety of crucial services during the buying process, emphasizing their integral role in successful transactions. The primary service buyers seek is help in finding the right home, which 49% of buyers identified as their top expectation.

Negotiating the terms of sale, aiding in understanding the home-buying process, and providing professional insights into market conditions are also frequently sought services.

For first-time buyers, agent support in understanding the process is especially invaluable, with 80% of responders highlighting it as critical. This reflects the trust placed in agents to streamline and demystify the often complex, daunting home-buying journey homes competitively and finding the right buyers.

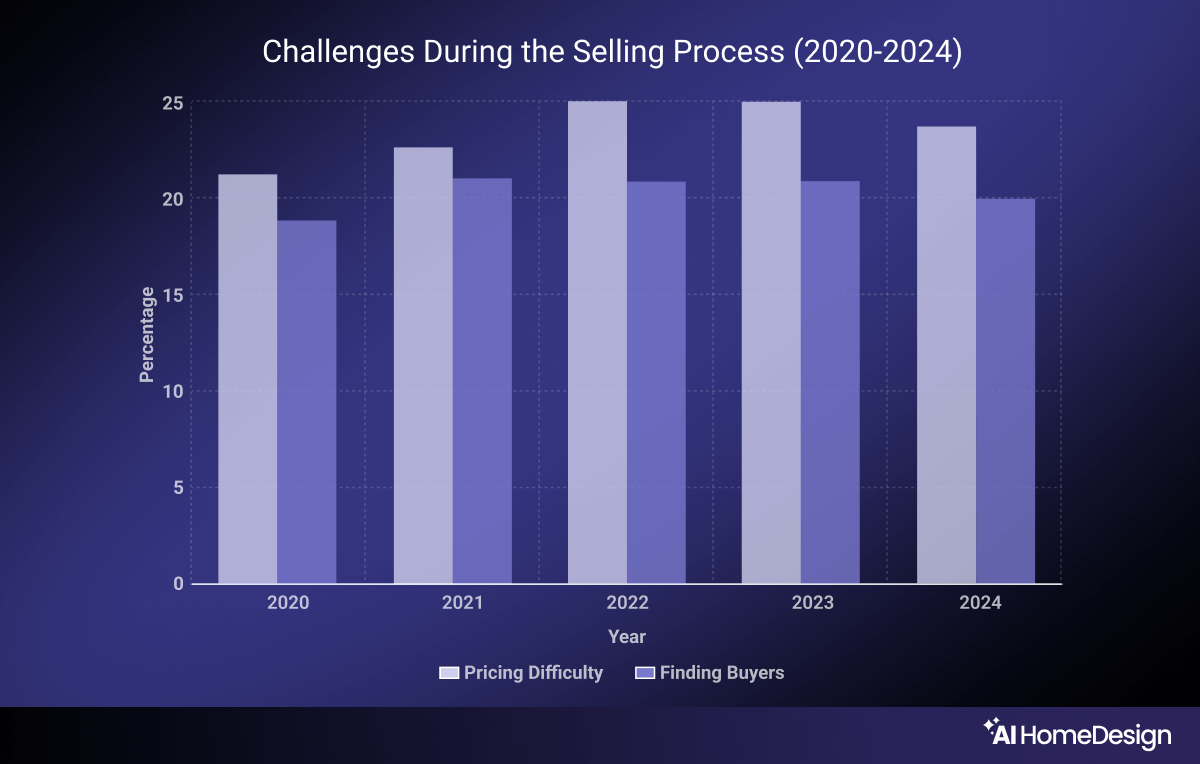

The difficulty of pricing peaked at 25% in 2022 and 2023 before slightly decreasing to 24% in 2024. Similarly, finding the right buyer was challenging for 19% of sellers in 2020, rising to 21% in 2021 through 2023, before easing to 20% in 2024.

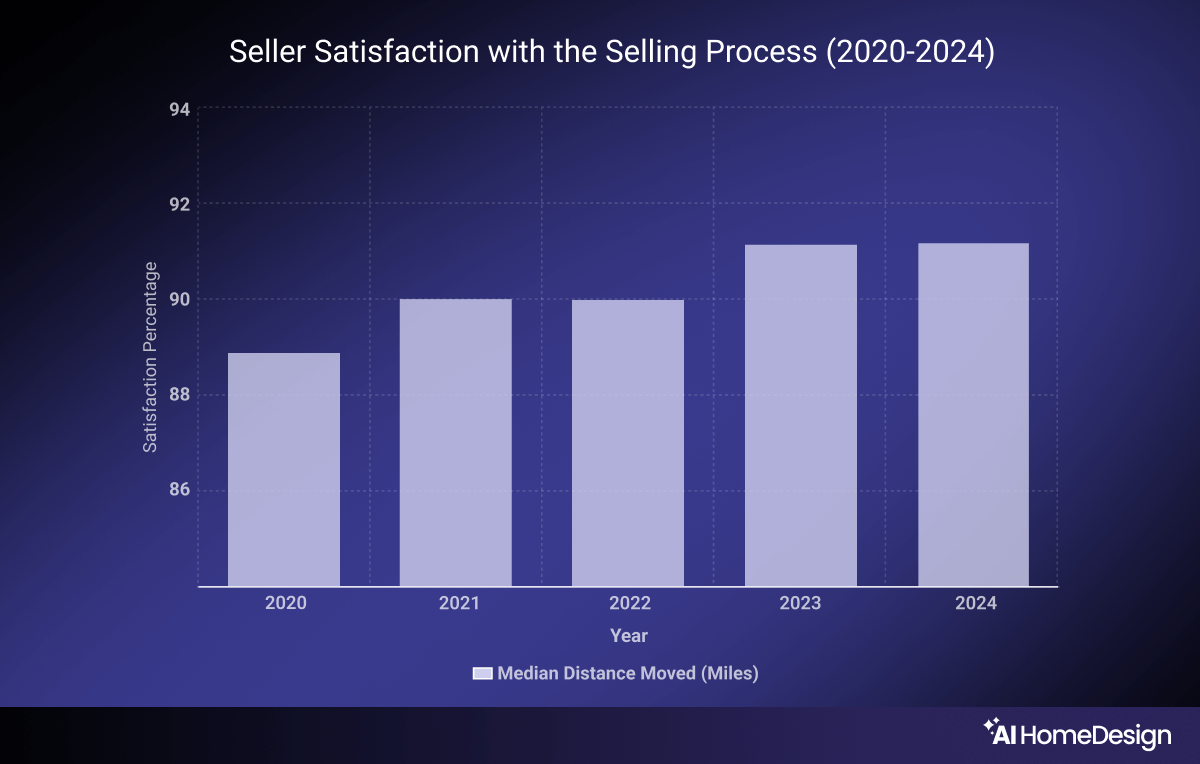

Seller satisfaction

In these 5 years, seller satisfaction with the home-selling process remained consistently high. In 2020, 89% of sellers reported their satisfaction with the selling process, increasing to 90% in 2021 and remaining steady through 2022. Satisfaction rose slightly to 91% in 2023 and held at that level in 2024, reflecting a positive trend in the overall experience of sellers during this period.

Pricing and timing of home sales

The pricing and timing of home sales across the 2020 to 2024 NAR profiles highlight consistent trends shaped by market conditions. Sellers typically priced homes competitively, often achieving 100% or more of the asking price, with one-third of sellers in recent years receiving offers above the asking price. Homes sold swiftly, with most properties being sold within two to three weeks of their listing date, reflecting high demands and limited inventory.

Home Selling and Real Estate Professionals

During the period in question, sellers most often cited 1) the desire to be closer to family and friends, 2) the need for larger or smaller homes, or 3) changes in personal circumstances as their primary reasons for selling a house. Common challenges included preparing their homes up to market standards, marketing them effectively, and timing the sale to achieve optimal outcomes.

Nearly 90% of sellers relied on real estate agents to price homes competitively, negotiate favorable terms, and attract buyers through professional marketing strategies like online listings and photography. Homes typically sold for the asking price, with about 30% receiving offers above it. Also, most properties were sold within three weeks, reflecting high market demands and limited inventory.

During the 5-year timespan, sellers consistently selected agents primarily through referrals, with approximately 40% choosing their agent based on recommendations from friends, family, or neighbors. Regarding repeat sellers, 21%-37% of them returned to agents they had worked with previously.

Most sellers, that is 70%-80%, interviewed only one agent before making their decision. Notably, almost 90% of sellers across these five years expressed satisfaction with their agents, with a majority stating they would recommend their agent or work with them again.

Financing the Home Purchase

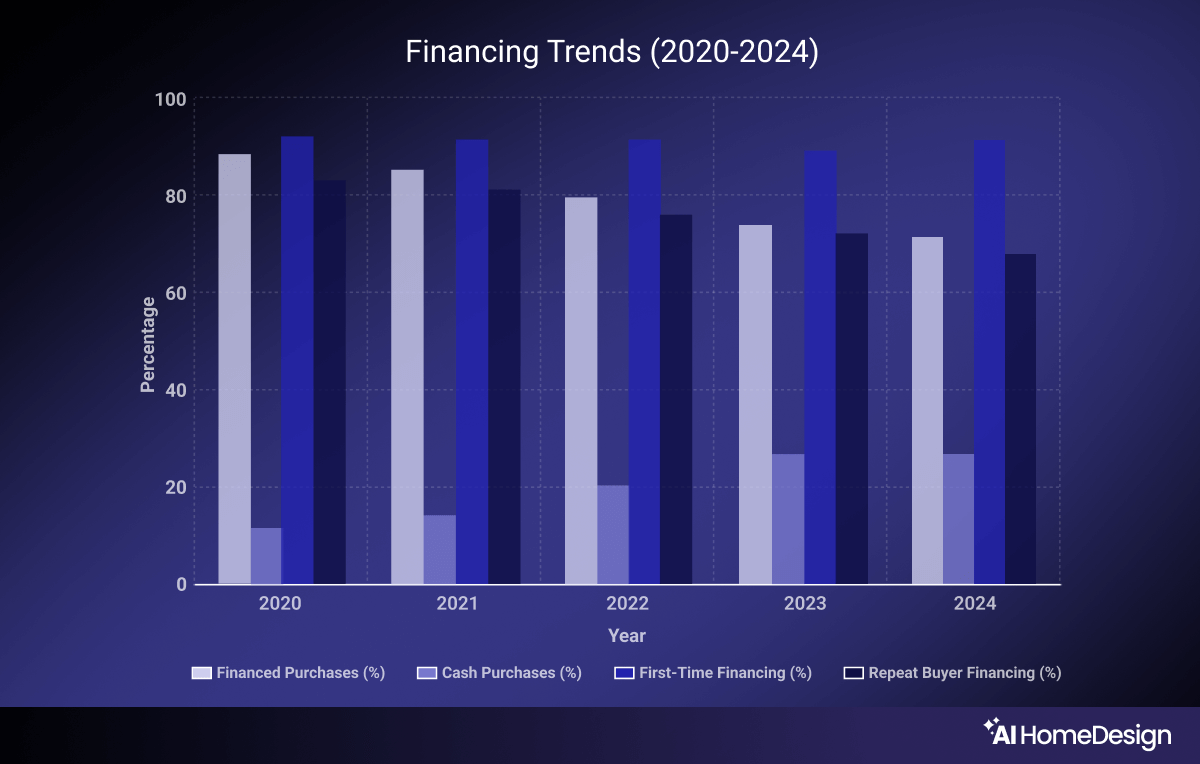

From 2020 to 2024, financing trends for home purchases shifted significantly, reflecting changing market conditions. The share of buyers financing their homes dropped from 88% in 2020 to 74% in 2024, driven by an increase in repeat buyers paying in cash, which rose from 20% to 26% during this period.

First-time buyers consistently relied more on financing, with over 90% using loans annually, while repeat buyers’ reliance on financing fell notably from 83% in 2020 to 69% in 2024. Typical down payments also grew, particularly for first-time buyers with a slight increase from 6% in 2020 to 9% in 2024. This slight change, though, brought this factor to its highest level since 1997, as buyers needed stronger offers in competitive markets.

For repeat buyers, down payments rose from 16% in 2020 to 23% in 2024, the highest since 2003, supported by increasing home equity. These trends underscore rising financial barriers for first-time buyers and the growing role of equity and cash in the purchasing process.

In Conclusion

The NAR Profile of Home Buyers and Sellers offers a lot to learn, especially when considering the past five years. Three findings stand out among the key takeaways.

- First, The shrinking number of first-time buyers is a significant trend, likely driven by rising home prices and down payment requirements that many can’t meet.

- Second, satisfaction with agents has steadily improved for both buyers and sellers. This suggests that agents have been delivering strong results and building trust with their clients.

- Finally, the increasing wait periods to find the right home highlights the intense competition in the market, with buyers facing more challenges than before.

The present study aimed to put together the findings of the past five years to provide a more inclusive picture of the US real estate market. As NAR continues reporting on home buying/selling every year, our market understanding deepens.

Thanks to these reports, we have learned a big deal about market shifts, clients’ preferences and expectations, marketing trends, agents’ strategies, and the role of technology in home selling or buying. By examining these evolving factors, stakeholders in the real estate industry should continue to refine their strategies and ultimately deliver better experiences for both sellers and buyers.

This article has been produced by AI HomeDesign based on the data and information gathered from the NAR Profile of Home Buyers and Sellers below: