When it comes to making money off a property, deciding what to do can be a challenging choice. The decision between selling your house for a lump sum or renting it out for ongoing income is rarely straightforward.

A common example could be a family relocating for a new job opportunity who must choose between selling their beloved home or renting it out while they’re away. Or a homeowner who’s inherited a property and is torn between cashing in now or holding onto a long-term investment.

In both cases, the question of renting your house vs. selling it can feel overwhelming, with significant financial and emotional implications to follow.

Renting Your House vs. Selling It: Which Is It Then?

Selling your home

Selling a home is a major financial transaction that can provide immediate access to your equity and free you from property management responsibilities. When you sell, you’re closing one chapter and opening another, often using the proceeds for your next move or investment.

financial implications

- Immediate equity access: Selling provides a notable sum, which can be used for purchasing another property, investing, or other financial goals.

- Transaction costs: Be prepared for expenses such as agent commissions (typically 5-6% of the sale price), closing costs, and potential capital gains taxes.

- Market conditions: Selling in a seller’s market can yield higher returns, while a buyer’s market might necessitate price reductions.

lifestyle considerations

- Relocation needs: If you’re moving for work or personal reasons, selling might simplify the transition.

- Emotional factors: Letting go of a home filled with memories can be challenging; consider your emotional readiness.

property condition

- Necessary repairs: Homes in need of significant repairs might deter buyers or reduce the sale price.

- Staging and presentation: Investing in professional staging and minor upgrades can enhance appeal and potentially increase offers.

Renting your home

Renting your house vs. selling it means stepping into the role of landlord, which comes with both opportunities and challenges. Renting can bring ongoing income and allow you to benefit from future appreciation, but it also requires active management and financial preparedness.

financial considerations

- Steady income stream: Renting can provide a monthly income, which may cover mortgage payments and generate profit.

- Tax benefits: Landlords can often deduct expenses like mortgage interest, property taxes, insurance, and maintenance costs.

- Long-term appreciation: Holding onto the property allows you to benefit from potential increases in property value over time.

landlord responsibilities

- Tenant management: You’ll need to handle tenant screening, lease agreements, rent collection, and addressing tenant concerns.

- Maintenance and repairs: Regular upkeep is essential to maintain property value and tenant satisfaction.

- Legal compliance: Familiarize yourself with local landlord-tenant laws to ensure compliance and avoid potential disputes.

market dynamics

- Rental demand: Assess the demand for rentals in your area to ensure consistent occupancy.

- Competitive pricing: Set a rental price that reflects market rates while covering your expenses.

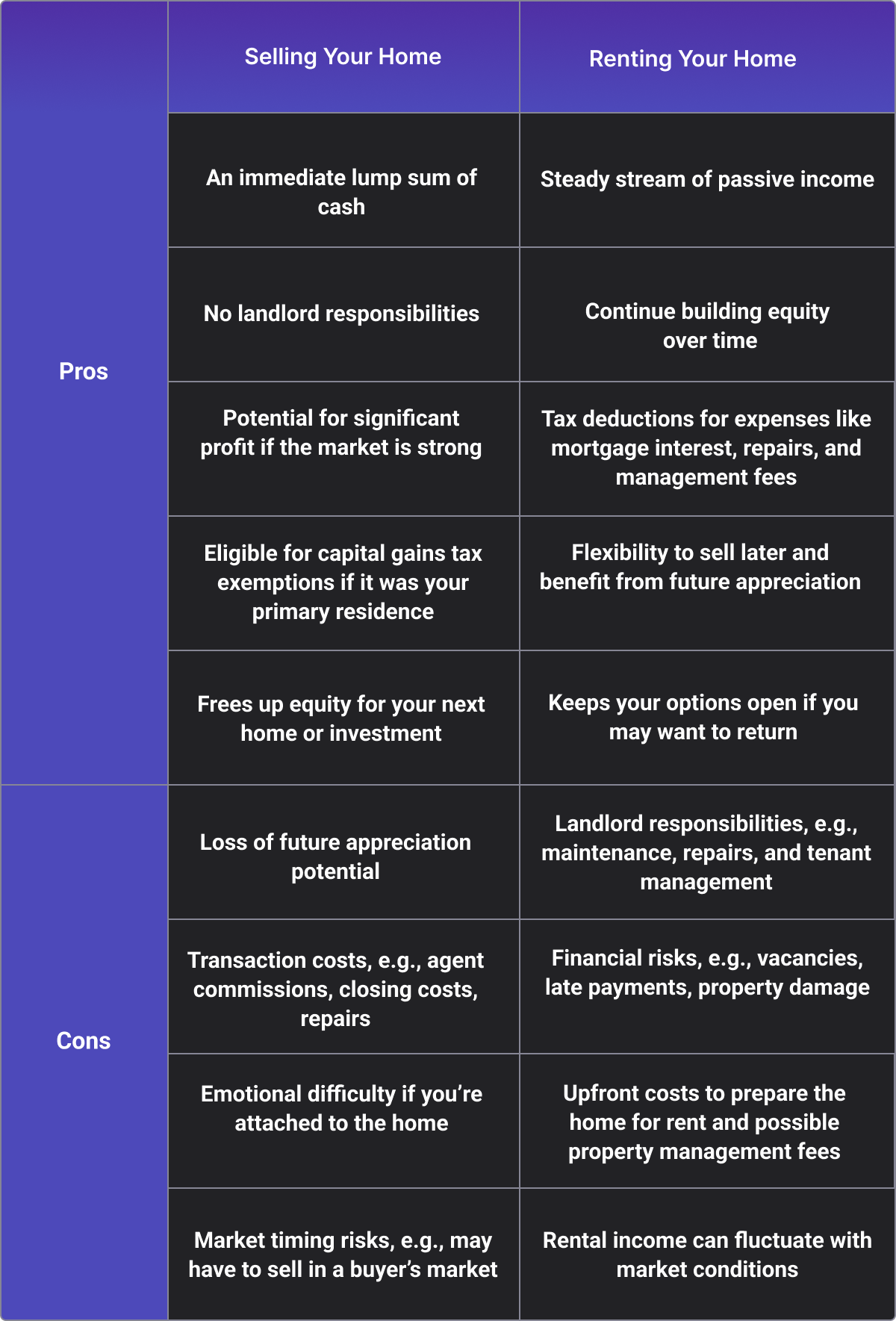

To help you weigh your options, here’s a comprehensive table outlining the key pros and cons of renting your house vs. selling it:

Selling vs. renting: Pros and cons

When Is It Better to Sell, and When Is It Better to Rent?

The choice between renting your house vs. selling it should be guided by your financial situation, local market conditions, and future plans. Selling is often the best option if you need immediate funds for your next home, want to avoid the stress of being a landlord, or the market is hot and prices are high.

On the other hand, renting may be preferable if you plan to return to the area, want to build long-term wealth, or your local rental market is strong and can provide reliable income.

Decision-Making Framework: Renting vs. Selling Your Home

To help you navigate your path to a suitable final decision, we’ve prepared a comprehensive yet easy-to-understand decision-making framework below. This framework breaks the decision into six key dimensions. Each dimension contains specific criteria and questions to help you reach a well-informed decision.

1. Financial position & objectives

Ask: What do I need financially right now: liquidity or long-term gains?

Short-term need for capital?

- Yes, selling might be better (e.g. buying a new home, paying debt, investing elsewhere).

- No, renting becomes viable for long-term income and appreciation.

Stable emergency fund in place?

- Yes, you can weather rental vacancies and repairs.

- No, selling might give you more stability.

Expected ROI from renting vs. selling

Run a Cash Flow vs. Sale Proceeds Analysis:

Net Rental Income: Monthly Rent – Monthly Expenses (including property taxes, insurance, repairs and maintenance, mortgage payments, property management fees, vacancy reserve, etc.)

After-Tax Sale Profit: Sale Price – (Selling Costs + Remaining Mortgage + Capital Gains Tax), with selling costs including realtor commission (often 5–6%), closing costs, home prep/renovation costs before selling, and capital gains taxes (if not fully exempt).

2. Market conditions

Ask: What’s happening in the real estate market on both the sales and rental sides?

- Is it a seller’s market?

High demand and low inventory = higher prices = good time to sell.

- Is it a strong rental market?

High rental demand, low vacancy rates = strong case for renting.

Interest rate environment?

High rates = harder for buyers = may be better to rent until rates drop.

Low rates = more buyers = better environment to sell.

Seasonality matters:

Spring/Summer = better time to sell.

University towns = strong rental demand in August/September.

3. Lifestyle & future plans

Ask: How does this property fit into your life now and in the future?

- Will you ever live there again?

Yes, renting gives flexibility.

No, selling might be more practical.

- Do you plan to move abroad or relocate long-term?

Renting from a distance may not be ideal unless you hire a property manager.

- Are you comfortable being a landlord?

Consider time, stress, and emotional bandwidth, not just money.

4. Property-specific considerations

Ask: Is this property well-suited to rent or better to sell?

- Condition of the property

Needs major repairs? Better to sell.

Move-in ready? Good for renting.

- Location suitability

Near universities, transport, or hospitals? More rent-friendly.

Luxury area with fluctuating buyer trends? Maybe better to sell at a high.

- Type of home

Condos with high HOA (Homeowners Association) fees may not generate good rental cash flow.

Single-family homes often appreciate better and attract stable tenants.

5. Emotional readiness & risk tolerance

Ask: How comfortable are you with uncertainty and letting go?

- Emotional attachment to the home?

If high, consider renting temporarily until you’re ready to sell.

- Tolerance for risk & uncertainty?

Renters defaulting, vacancies, emergency repairs: Are you mentally and financially ready?

- The desire for simplicity?

Selling gives closure; renting requires ongoing decision-making.

6. Legal, tax, and management factors

Ask: Are you ready for the legal and tax implications of either option?

- Capital gains tax exposure?

Primary residence exemption available? Sell now.

Losing the exemption after 3 years of renting? Sell before that deadline.

- Rental licensing & local laws?

Some cities have strict landlord requirements or rent control laws.

- Will you use a property manager?

Budget 8–12% of rental income for management services.

No manager? Make sure you’re available and capable.

Expert Tips for Each Scenario

If you decide that selling your home is the best path, preparation is key to maximizing your outcome.

Property condition

Start by making sure your property is in top condition; minor repairs, a fresh coat of paint, and professional staging can greatly enhance your home’s appeal to potential buyers.

Agent representation and timing

Partnering with an experienced real estate agent is also invaluable; a good agent will help you price your home competitively, market it effectively, and negotiate the best possible deal. Timing your sale can make a substantial difference, so keep an eye on local market trends and aim to list your property when demand is high and inventory is low, increasing your chances of a quick and profitable sale.

Tenants screening

On the other hand, if you choose to rent out your property, it’s important to approach the process with a landlord’s mindset. Start by thoroughly screening potential tenants, checking credit scores, references, and rental histories to minimize the risk of late payments or property damage.

Expenses and insurance

Financial preparedness is essential; set aside a reserve fund to cover vacancies, unexpected repairs, and routine maintenance so that your cash flow isn’t disrupted by unforeseen events. It’s also wise to require that your tenants obtain renters’ insurance. This not only protects their personal belongings but can also provide liability coverage in case of accidents, reducing your own risk as a landlord and helping to avoid disputes over damages. For more details, read this renters insurance guide.

Property management

Last but not least, if you’re not interested in the day-to-day responsibilities of being a landlord or if you’ll be living far from the property, consider hiring a reputable property management company. While this service comes at a cost, it can save you time, reduce stress, and ensure your investment is well cared for, especially if you’re new to renting your house vs. selling it.

At the Crossroads: Make the Right Move

The decision of renting your house vs. selling it is deeply personal and depends on several factors. Take the time to weigh the pros and cons of each option, consider your long-term plans, and seek expert advice if needed. For an easier time, go down the decision-making framework we provided.

Whether you choose to sell for a fresh start or rent for ongoing income, making an informed decision will help you achieve your goals and bring peace of mind for the future.

FAQs

As a landlord, you can typically deduct expenses such as mortgage interest, property taxes, insurance, repairs, maintenance, utilities, and property management fees. Improvements, however, must be depreciated over time rather than deducted all at once.

When you turn your home into a rental, you may be eligible for depreciation deductions while renting it out, but when you sell, you could face depreciation recapture taxes in addition to capital gains taxes.

Yes, requiring renters’ insurance is a good practice. It protects tenants’ personal belongings and provides liability coverage in case of accidents, which can help prevent disputes and reduce your risk as a landlord.